Structuring the asset portfolio for retirement

Congratulations! Getting to the stage where you have enough assets to see you through a retirement for at least 30 years is an achievement in itself. But that is not the end of the story. You don’t get to ride off into the sunset until you have gone on to the next stage. And that next stage is figuring how you should be structuring the asset portfolio you have built up over the years of working, earning, saving and investing, into something for retirement.

But wait! You mean that the process of structuring the asset portfolio for retirement, the asset allocation and all that, is going to be different? After all, most people who have made it thus far to their retirements, early or otherwise, will have a pretty good idea of investments and all that. How hard can it be? Well, for a start, in retirement, there is no longer any income from work. And you’ll have to start living off both the income and capital of the assets you have acquired or amassed over time. What this means is that you can no longer just continue to pour money into the asset portfolio regardless of their ups and downs, but instead, start running it down.

And in most cases, this scares people, the very thought that the asset portfolio may or will start shrinking over time. What if the money runs out after 20 or 25 years? So while a lot of inspiration and finance theory focuses on how to structure an asset portfolio during the income earning or accumulation phase, far less thought has been spent on thinking about how be to go about structuring the asset portfolio for retirement, or for decumulation. So let’s start thinking about it!

Thinking about structuring the asset portfolio for retirement

Two approaches to structuring the asset portfolio for retirement

When we are accumulating assets for retirement, the process is relatively straightforward:

- Invest in a diversified portfolio of assets, with the majority in higher risk ones, like stocks

- Regardless of how the market behaves, avoid selling investments. In fact, continue to add on to the portfolio with work income

In retirement, the obvious change will be that income from work disappears. And you will start selling investments, in addition to not reinvesting the dividend and interest income earned from the portfolio to support expenses in retirement. But does the asset allocation or the product allocation for the portfolio change in retirement?

The short answer is, it depends. Depends on what? A number of factors, but mainly on whether you believe that historical financial outcomes will repeat in the future versus contractual guarantees, and whether your retirement expenses can be flexible enough to be cut depending on asset returns. These factors determine how you should structure your asset portfolio for retirement between two broad approaches, namely:

- The probability-based approach

- The safety-first approach

These two approaches and the factors which influence the choice of either have been discussed in length by Murguia and Pfau (2021), as well as by others such as Milevsky and Macqueen (2015), and the following discussion draws heavily from their work.

The Probability-Based Approach to Structuring the Asset Portfolio for Retirement

The probability-based approach is the approach to retirement withdrawal and spending based on the 4 percent rule. The idea is that we can start our retirement by withdrawing 4% of the value of our assets initially, and increasing this withdrawal amount (in dollars) by the rate of inflation every year thereafter. The 4% “safe withdrawal rule” is a rule of thumb to ensure that, even with no other sources of income, we will not outlive our retirement funds.

The origins of the 4 percent rule lie in a paper by William Bengen in 1994. Bengen examined the returns on portfolios of US stocks and bonds starting from 1928 (right before the Great Depression) to see if there was a withdrawal rule which would have ensured that retirees would not outlive their funds over a retirement period of 25 to 30 years. The work shows that an initial 4% withdrawal rate from the retiree’s portfolio, adjusting for inflation every year, meets this criteria, provided 50% to 75% of the portfolio is in stocks.

The variants of this 4 percent rule have are exhaustively documented by Pfau (2017) and you can read an introduction to it here as well. In essence, you will keep the structure of the asset portfolio approximately the same in retirement as it was during the accumulation phase, and sell assets as necessary to fund retirement spending. The critical thing to note about it is that it is not grounded in any any theory of finance, but is an observation from history. That is to say, the probability-based approach to structuring the asset portfolio for retirement should work because it has worked in the past, but there are no guarantees.

Past performance is no guarantee of future outcomes for the probability-based approach

The Safety-First Approach to Structuring the Asset Portfolio for Retirement

The safety-first approach to structuring the asset portfolio for retirement involves the use of annuities, such as CPF Life (see also here and here). Unlike the probability-based approach, there is a substantial amount of finance theory which supports this approach. For example Yaari (1965) finds that if the retiree has no bequest motive, they should put all their assets into annuities. Unfortunately, unlike the probability-based approach, there is also little empirical evidence that people make their decisions in this manner, as very few people fully annuities their retirement savings!

However, the lack of evidence does not invalidate the need for annuities. Why? Many of these studies are in countries where there is a government pension (like Social Security in the US or CPF LIFE in Singapore), and hence a retiree who has little apart from the pension and his/her house will not be putting much, is any, assets into private annuities. For the better off retirees with more assets, the rate of annuitisation is also low, but that can be due to having enough assets not to run out during retirement, and hence no there is no need for them to purchase more annuities.

The benefits of the safety-first approach are obvious, that is, there is never any chance of running out of money in retirement. This makes this approach attractive for those who are risk averse. However, as discussed in Pfau (2019) and Milevsky and Macqueen (2015), a mixture of assets and annuities can end up being a better choice. It can both decrease the risk of failure of a pure probability-based approach, and may also end up with more assets to bequest to heirs. Win-win!

What Determines How We Structure Our Assets for Retirement?

So, how do we know if we should choose the probability-based approach of the usual diversified stock-bond portfolio, or the safety-first annuity portfolio for retirement? Or perhaps a mixture of the two? Murguia and Pfau (2021) find that there are 6 factors which help determine the most appropriate retirement asset portfolio structure. Of these the first two are the most important, and these are:

- Probability-Based vs Safety-First: Preference for sourcing retirement income from the probability-based approach (total returns from a diversified portfolio), or a safety-first portfolio of annuities. Clearly, this will also depend on the retirees’ beliefs about which method will work in the future, and their risk tolerance

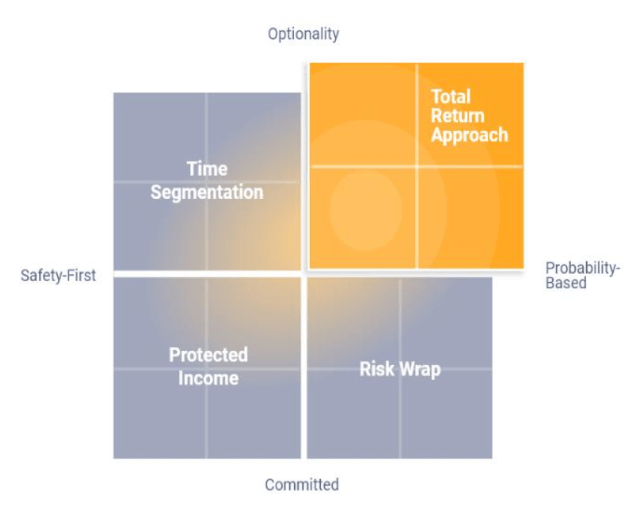

- Optionality vs Commitment: This details the flexibility available with respect to income sources. Optionality refers to having flexibility for retirement spending to respond to market movements, and keeping the options open, in case of future emergencies which may require extra spending. Commitment refers to a preference fo keeping retirement income fixed and steady, regardless of what else happens. In part, this may also be influenced by how much of retirement spending is on fixed expenditures (e.g. food, housing, health) versus lifestyle expenditures (e.g. travel, hobbies, gifts)

So, how will the interaction of these two factors look like? The diagram below gives us an idea:

Top right quadrant

A retiree who believes in the probability-based approach of something like the 4 percent rule, and has sufficient flexibility around retirement expenditures may prefer to structure the asset portfolio just like they did during the accumulation phase. This relies on both capital gains and investment income to provide the basis of retirement spending.

Bottom left quadrant

In contrast, someone who is more risk averse, and has less flexibility in modifying retirement spending may prefer the safety-first approach of annuitising the majority of their retirement assets, enjoying a fixed stream of income over time (perhaps indexed against inflation, like the Escalating Plan of CPF LIFE).

The other quadrants

For the other 2 quadrants, Murguia and Pfau (2021) postulate that the retirees may either structure their asset portfolios as some form of a risk wrap (i.e. insurance wrapper) or use time segmentation instead for retirement.

However, their recommendations do seem a little odd. In our view, a retiree in the bottom right quadrant, who has more committed than flexible expenditures, and believes in the 4 percent rule but wishes to avoid the worst of Sequence of Returns Risk would be better served by using time segmentation in conjunction with a diversified portfolio, rather than a risk wrap. The buckets of cash and bonds, perhaps covering the first 5 to 10 years of spending, will protect committed expenditures against the need to cut back due to sequence of returns risk. And the diversified portfolio, from which retirement expenditures will be drawn from after the first 10 years, will have grown over time to comfortably support spending thereafter.

Similarly, a retiree in the top left quadrant actually be better off using a risk wrap approach instead of the time segmentation approach Murguia and Pfau (2021) recommend. In a risk wrap approach, the retiree uses an insurance solution, for example a variable annuity, or a whole life insurance product, in order to provide downside protection (safety-first) while allowing for some participation in the market movements on the upside (optionality). Net, we must recognise that there is considerable leeway in interpreting what retirees may want.

And in fact, the way retirees go about structuring their asset portfolios for retirement may be a hybrid of the approaches rather than an either or approach. As Pfau (2019) and Milevsky and Macqueen (2015) show, a mixture of annuities and a diversified portfolio can potentially give better success probabilities than the pure 4 percent rule, and the chance to participate on the market upside than a pure annuity solution. Hence the difference between the top right and bottom left quadrants may be between having 30% of the asset portfolio in annuities and 70% in a diversified portfolio, versus having 70% in annuities and 30% in a diversified portfolio!

What About the Other Factors Which Affect Structuring of the Asset Portfolio for Retirement?

We have covered the most important two factors which affect the structuring of asset portfolios for retirement. What about the others? According to Murguia and Pfau (2021) they are as follows:

- Time based vs Perpetuity: This refers to desire to build income streams which can never run out, or if there is flexibility to cut back as and when required

- Accumulation vs Distribution: a wish to accumulate for bequests would require less annuities and more in the diversified portfolio

- Front loading vs Back loading: This refers to whether retirement expenditures are mostly in the early years of retirement (travel and hobbies) or later years (healthcare)

- True vs Technical Liquidity: True liquidity is when there are excess assets which can be used for emergency spending or gifting. Whereas technical liquidity refers to assets in the diversified portfolio used to support spending, which are technically liquid in nature, but yet are encumbered

Thankfully, having to consider more factors for retirement planning doesn’t actually complicate things. Murguia and Pfau (2021) show that most of these other factor overlap with the 2 important ones, as follows:

Therefore, the structuring of the asset portfolio for retirement is still largely a choice between more of a diversified portfolio, or more of annuities. All it takes is slotting the assets into the right places, according to the retirees preferences and beliefs.

Conclusions

One significant omission in a lot of personal financial planing or advice, especially for retirement, is how to structure the asset portfolio for retirement. More often than not, financial advisors focus on computing the amount of assets needed to sustain retirement, and on structuring an asset portfolio to accumulate this amount. But there is little advice on how then the assets can be structured once retirement is reached. Thankfully, there is some very good thinking and work going on right now which sheds more light on this.

References

Moshe A. Milevsky and Alexandra C. Macqueen (2015) Pensionize Your Nest Egg: How to Use Product Allocation to Create a Guaranteed Income for Life, 2nd Edition, John Wiley

Menahem E. Yaari (1965) Uncertain Lifetime, Life Insurance, and the Theory of the Consumer. The Review of Economic Studies, Volume 32, Issue 2, April 1965, Pages 137–150