Do Property Market Cooling Measures Work? Why ABSD does not work

The property market in Singapore has been all abuzz since 27 April 2023 when the latest round of property market cooling measures were introduced, amidst the unrelenting rise in property prices. Property market cooling measures have been introduced in the Singapore market since as far back as 1996 (see this Business Times article for a full summary), although the more current measures of Additional Buyer’s Stamp Duty (ABSD), Loan-to-Value (LTV) and Total Debt Servicing Ratio (TDSR) restrictions date back to 2011. So, do property market cooling measures work? And more specifically, will the ABSD hikes (up to 60% for foreigners) work?

Do Property Market Cooling Measures work?

A History of Property Market Cooling Measures in Singapore

Singapore has a long history of using various measures to try to cool the property market over the years. In addition to the measures such as ABSD, LTV and TDSR restrictions mentioned earlier, the imposition of Seller’s Stamp Duty (SSD) was also used in the period prior to 2011. However, in recent years, the use of ABSD, especially targeting the purchase of a second residential property by residents and any residential purchase by a foreigner, have become more common. This stamp duty has soared in recent years:

Additional Buyer’s Stamp Duty Levied

| Date Introduced | Citizens | Permanent Residents | Foreigners |

|---|---|---|---|

| Before Dec 2011 | 0% | 0% | 0% |

| From 8 Dec 2011 | 0% on 1st property 0% on 2nd 3% on 3rd | 0% on 1st property 3% on subsequent | 10% on every property |

| From 12 Jan 2013 | 0% on 1st property 7% on 2nd 10% on 3rd | 5% on 1st property 10% on subsequent | 15% on every property |

| From 6 Jul 2018 | 0% on 1st property 12% on 2nd 15% on 3rd | 5% on 1st property 15% on subsequent | 20% on every property |

| From 16 Dec 2021 | 0% on 1st property 17% on 2nd 25% on 3rd | 5% on 1st property 25% on 2nd 30% on subsequent | 30% on every property |

| From 27 April 2023 | 0% on 1st property 20% on 2nd property 30% on 3rd property | 5% on 1st property 30% on 2nd property 35% on 3rd property | 60% on every property |

The chart below (from SRX) give a perspective of these measures over the past 15 years. This is obviously a very large chart, and it is far better to view it at the source.

Timeline of Property Market Cooling Measures and Non-Landed Property Resale Price Index and Sales Volume

One thing which stands out from this timeline of the cooling measures is really how ineffective they have all been! Apart from the period 2014 to 2016, where the private property resale prices dipped and flattened, property prices have been going up relentlessly, cooling measures or not. And even in the period 2014-2016, there were other changes in the property market which may have contributed to the slowdown in property prices (see here for example, the large rollout of public housing which serves as a substitute for lower end private housing).

More specifically, in all the 4 previous instances where the ABSD was raised, it can be quite clearly seen that the non-landed property prices did not cool off, and what was affected was only the sales volumes.

ABSD as a property market cooling measure has not worked in the 4 past episodes, so there is little likelihood of it working this time to cool property prices

Even if the ABSD were used as a purely as a means of taxation, the outcome is not good as the lower volumes of sales simply means less tax to be collected potentially. What is behind this?

How does ABSD work anyway?

To get a better idea as to why property market cooling measures do not seem to work, and more specifically, why the government’s favourite tool, ABSD, has no effect on rising property prices, it is useful to go back to understanding how a tax like ABSD works.

Basic economics tells us that the market prices for anything can be set by demand and supply. In most cases, the supply curve (SS) is upward sloping, meaning that as the price rises, more supply will come onto the market. Also the demand curve (DD) is downward sloping, meaning that as prices are higher, less will be demanded, and vice versa. Where the demand and supply curves intersect will determine the market price and quantity transacted.

Determining the Price and Quantity Transacted using Demand and Supply Curves

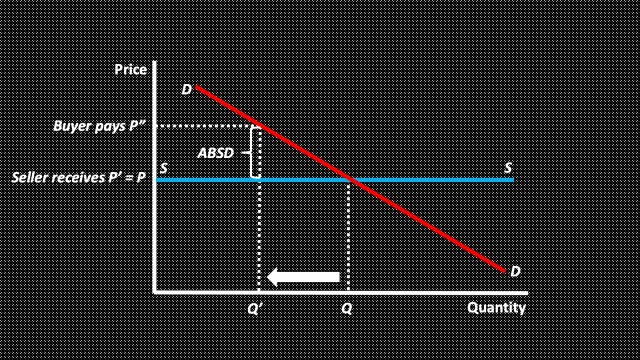

When a tax like ABSD is imposed on the market, the demand and supply curves are unaffected. Instead, the tax drives a wedge between the price the buyers pay, and the price the sellers receive, with the difference going to the government as tax revenue. The final market price and quantity transacted will then adjust depending on the demand and supply curves. In terms of quantity, the adjustment will be along the supply curve (you cannot sell more than what is supplied). In terms of price, buyers will pay according to the demand curve, while sellers will receive proceeds based on the supply curve.

Price and Quantity Transacted with ABSD

What is interesting to see here is that while ABSD is a buyer’s stamp duty, it does not mean that the entire burden of the tax necessarily falls on the buyer. In the example above, the tax burden is actually shared between the buyer (in the form of higher prices paid, but not to the full extent of the tax on the previous price level) and the seller (in the form of lower prices received). Also, the imposition of a tax like ABSD will have effects both on the price and the quantity transacted, both falling in this case.

The curious case of the Singapore Property Market

But that is not the case for the property market in Singapore. A closer look at the market response to the last two rounds of ABSD when the tax hikes got higher and higher shows that the price level did not fall, but the quantity transacted fell sharply for a while. What can be happening to make the outcome so anomalous to the theoretical cases discussed above?

A Closer Look at the Effects of ABSD on the Non-Landed Property Market

As alluded to above, this unusual outcome may be because the shapes of the demand and supply curves differ from the cases discussed above. While it is unlikely that the demand curve will be significantly different from being downward sloping (unless buyers are irrational), the upward sloping supply curve may not fit the property market precisely. Why? Let’s think about it. Unlike most goods, properties are not perishable, and the sellers can hold them indefinitely, and even earn an income from rental while waiting for a buyer to meet their asking price. Property supply is also fixed in the short run, as new properties take time to come onto the market (and the charts above show resale properties, which take even longer).

Is the Supply Curve of Property Vertical?

If property supply is fixed in the short run, it may be that the supply curve is vertical, implying that there is no elasticity at all in the supply. Is this the case? The diagram below shows what will happen when ABSD is imposed in such an instance.

Effect of ABSD when the supply curve is vertical

If the supply curve of property is vertical, then we should expect the imposition of ABSD to depress the price level, but not reduce the quantity transacted. Incidentally, the sellers will be the ones bearing the impact of the tax in this case! But that is not what we see, which is no change to the price and falling quantities transacted. So it appears that the supply curve for property is NOT vertical.

Is the Supple Curve for Property Horizontal?

Let’s consider the other case instead – can it be that the supply curve for property is horizontal? This is not as far-fetched as it may sound, given the unique characteristics of property. Since it is not perishable, and there are no penalties for holding on to the property due to the rental income which can be earned, plus there is no immediate new supply of properties which forces the sellers cut their asking prices to clear their inventories, in the face of a property market intervention which can depress prices, like the imposition of ABSD, the sellers can simply choose to withdraw their properties for sale and wait to see if their asking prices can be reached. This is almost like the case where every property seller has a reserve or minimum price, and can simply refuse to sell if this is not met.

Effect of ABSD when the supply curve is horizontal

If the supply curve of property is horizontal, the imposition of ABSD will have no effect on the price, but will result in a drop in the quantity transacted. Which is exactly what we have seen in the last 2 rounds of ABSD! And this is also true of the first 2 rounds of ABSD as well, even if the magnitude of the tax back then was much smaller.

Because of the unique nature of the supply of property, imposing ABSD will not have much, if any, effect on cooling the property market by lowering prices

And this is something that is already apparent in this most recent round of property cooling measures using ABSD. Some large developers have decided to hold back on launching sales of new properties to wait and see what will happen, instead of cutting prices. Elsewhere, new property launches have seen no effect on the asking prices as well.

Conclusions: ABSD does not work as a property market cooling measure

So, do property cooling measures work in Singapore? Not if it is done using ABSD. Both historical evidence and theoretical analysis show that ABSD is next to useless as a property market cooling measure, due to the unique characteristics of the property market supply curve. As a tax, it is also fairly ineffective, since the associated fall in quantities transacted actually reduce the maximum amount of tax payable through ABSD. So what is ABSD for, really?

The magnitude of the ABSD hikes in this fifth imposition of ASBD took many by surprise. Perhaps, ABSD is really just “full of sound and fury, signifying nothing“. Maybe it is more of a signal that something needs to be done with rising property prices, just not yet. Perhaps it is a signal that foreigners are effectively banned for purchasing property in Singapore, without being overtly anti-foreigner.

But what is also clear now, is that to actually cool the property market, measures taken have to somehow change the demand and/or supply curves of the property market. ABSD, being a tax which does not change either the supply of or demand for property, simply cannot do the job.

Some other good reads on property

- What Really Drives HDB Resale Flat Prices in Singapore?

- What’s the Value of my Leasehold Condominium (1)? Revisiting Mr Bala’s Table

- What’s the Value of my Leasehold Condominium (2)? Is freehold better or leasehold?

- What’s the Value of my Leasehold HDB (3)? Dealing with HDB Lease Decay

- The DBS Home Equity Income Loan: Good or Bad?

- Should I Pay Off My Mortgage Before Retiring Early?

- What Property Cooling Measures May Work in Singapore?

- Did the 2023 Property Market Cooling Measures Work?

3 thoughts on “Do Property Market Cooling Measures Work? Why ABSD does not work”