Dividend Investing: When does it work, and when doesn’t it work?

Dividend Investing is a popular approach for investing (see here, here and here). This seems to have picked up pace in the last 2 decades or so, especially since stock prices collapsed in a spectacular way in the Asian Financial Crisis of 1997/98 and in the Dot-Com crash of 2001. The ephemeral nature of price gains when investing in stocks made a steady stream of dividends seem much more valuable. In recent years, the focus on financial independence and growing passive income, especially in the face of career impermanence, also helped to promote the attractiveness of dividend investing. In fact, even The Wall Street Journal had this to say about dividend investing:

“The humble dividend is reclaiming its rightful place as the arbiter of stock-market value. […] To investors desperate for income, the argument for buying equities is, well, duh. Who wouldn’t want a higher income? Shares might swing around, but corporate managers go out their way to preserve the dividend.”

– James MacKintosh, The Wall Street Journal May 9 2016

Even after enduring cuts in dividends, both during the Global Financial Crisis of 2008 and again during the recent COVID-19 pandemic induced economic shutdown, dividend investors are still unfazed, so strong is the allure of dividends. But is dividend investing really all that it is made out to be by its adherents? Could there be times when it does work, and times when it doesn’t?

When does Dividend Investing work? And when doesn’t it work?

Why would Investors go for Dividend Investing?

One of the earliest pieces of research into dividend investing, all the way back in 1984 by Shefrin and Statman, posited that investors’ preference for dividend investing was due to several reasons, amongst them:

- To better exercise control over the management of the firm. i.e by demanding managers pay out dividends from earnings, shareholders ensure that the managers do not spend it on initiatives which are not beneficial to the shareholders

- As a form of self control, so as not to overspend by selling too much of their stocks and running out of money

- A preference for having something tangible in hand. i.e. a bird in the hand is worth two in the bush

- Loss and regret aversion, by getting dividends to make up for capital losses when investing in stocks

To a significant extent, these reasons for preferring dividends to capital gains require some sort of irrationality. Or succumbing to what is known as the “dividend fallacy” or the “free dividend fallacy”. Basically this means investors treat dividends much like the interest payments on a fixed deposit, or of a bond, having no impact on the price or value of the stock. This is like how paying out interest does not affect the value of the deposit or bond. So while we see investors do dividend investing, it does imply that there is something irrational about this behaviour!

Can Dividend Investing be harmful to your Wealth?

There is no shortage of theoretical reasons or empirical proof that dividend investing may actually end up harming your long term wealth! So, when doesn’t dividend investing work?

1. The Free Dividend Fallacy

The first of these is that dividends are paid out of the net asset value of the company, and so when the dividend is paid, the price of the stock goes down. It is not as if the payment of the dividends has no impact on the share price. There is no free lunch! In fact, dividend investing may mean that you get the same return as investing in other stocks, and it is just the composition of the returns that differs:

Dividends merely changes the composition of stock returns

Now, this assumes that the price of the stock is roughly equal to the Net Asset Value. But in a growing market, the price of the stock can be greater than the Net Asset Value. Much as what we are seeing for some markets right now, hence the worry about overvaluation. In such an instance, you might end up worse through dividend investing. For every $1 that is paid out of the Net Asset Value as a dividend, the stock price falls by more than $1!

But the free dividend fallacy goes beyond misunderstanding how the returns of investing in shares interact with the dividend paid. It also affects investment decisions, like whether to buy or sell a stock. There is evidence (here) that investors do not to take the dividends into account, both when assessing the investment returns of a stock, and when selling it to take profit. (Usually only the more profitable shares are sold to take profit).

Furthermore, as high dividend paying companies are usually those which have fewer investment opportunities to grow their core business, dividend investing may also result in constructing a portfolio of stocks which have lower overall returns, even when looking at total returns! But this is a contentious point, to put it mildly. While the dividend portfolio may have lower returns, it might be lower in risk (if dividends are stable over time). Hence, the risk-reward tradeoff can be the same even with dividend paying stocks.

2. Reinvestment of Dividends

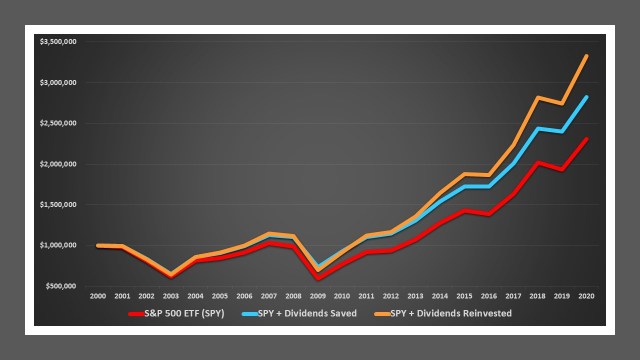

In the accumulation phase of life, in order to grow our wealth, we need to reinvest dividends. When we examined the relevance of dividends previously (here), we found that even for a market like the US (represented by the S&P500 index) which pays out a relatively low level of dividends, over the past 20 years, reinvesting dividends account for 23% of the return!

Investing in the SPY ETF with and without dividends reinvested 2000-2020

For other markets, such as Singapore, Europe, Asia, and Emerging Markets, the effect on total returns of reinvesting dividends is even higher! And again, there is evidence (here) that both retail investors, and institutional investors often fail to reinvest the dividends into the dividend paying stocks.

Investing in the Straits Times Index (ES3 ETF) with and without dividends reinvested 2002-2020

The saving grace here is that we do not necessarily need to reinvest dividends back into the same dividend paying stocks to benefit from the higher total returns over time. As long as the dividends are not spent, and instead ploughed into more investments, or even paying off debt, much of the gains from dividend investing can be realised over time. But only if the dividends are not spent. This, unfortunately, does not seem to be norm for dividend investing now. Dividend investing is usually touted as a source of passive income, to be used for spending.

These empirical findings about dividend investing ending up with lower returns is found in the work of Hartzmark and Solomon. (Also see here. And here).

3. Tax and timing issues with dividend investing

Another potential downside of dividend investing are issues around taxes and timing. Not every tax jurisdiction has taxes on capital gains and/or dividends. But in some places that do, like the USA, dividends are taxed as income, and at a higher tax rate than long term capital gains. As the investor can control the timing of capital gains to match when they become long term in nature, they can minimise taxes by selling shares as and when it benefits the investor. Dividends, on the other hand, pay out regularly. So, there is little the dividend investor can do but to pay up the income tax on them.

Even where taxes are not an issue, the timing of dividends may make a difference to the dividend investor. As we know, time in the market trumps timing the market. Selling shares for for cash as and when needed allows the investor to stay invested for as long as possible. Conversely, the dividend investor has to receive dividends as cash even when there is no need for cash. This ultimately reduces the investors’ time in the market.

Are there times when dividend investing can be beneficial?

So, both the theory and evidence is looking bleak for dividend investing. Is there any way out? But there is a vast amount of difference between personal finance and corporate finance, and there are differences in the needs and behaviour of investors at different points in their lives. And hence we should not expect that there are no situations where dividend investing may actually be beneficial. So, when does dividend investing work?

1. Using dividend income for investments, or for paying down debt

As we mention above, the good news about dividend investing is that you don’t really need to keep faithfully reinvesting the dividends back into the same dividend paying stocks in the portfolio to get most of the gains from this form of investing. All you need to do is to use these dividends wisely. Whether it is to invest in other investments, or to pay down debt elsewhere. While you may not be able to enjoy a growing stream of dividends over time, which would be the case if you had ploughed the dividends back into the same dividend stocks, you’d still be able to benefit from the gains on the other investments made.

Strangely enough, it may actually be better for dividend investors not to reinvest the dividends into the same dividend stocks. Dividend stocks tend to grow slower than other stocks, because they might have more limited growth opportunities. Hence investing the dividends elsewhere may result in faster portfolio growth at the end of the day!

In fact, the only thing you need to avoid doing is spending the dividends. Sounds easy, right? But dividend investment has caught on precisely because it is a way to gain passive income. So, the outlook for most investors does seem quite bleak. Because if that is the main form of thinking about dividend investing, then the likelihood is that all these newly minted dividend investors will end up spending the dividends, and thus handicapping the future growth of their investments.

As difficult as it may sound, the only way to go in dividend investing, is not to spend it!

2. As a hedge against Sequence of Returns Risk

One rather specific application of dividend investing is in the decumulation phase of our investing career. This is when we live off the returns of our investments during retirement. Whether you believe in the 4 percent rule or some other safe withdrawal rate rule, you’ll realise that the greatest threat to financial security in this decumulation phase is Sequence of Returns Risk. Sequence of Returns Risk is like dollar cost averaging in reverse, or as some may say, dollar cost ravaging. That is, as the market falls, we need to sell more and more shares at lower and lower prices, just to get enough cash for our expenses. Hence the value of our investments will fall faster than the market itself.

Hence, a way to hedge against this risk is to sell as few shares as possible during a downturn. And dividend investing, or using a Yield Shield, helps us do this, as the stream of income from dividends partially alleviates the need to sell shares for cash. Even where dividends are cut in the face of a severe market and economic downturn, dividend investing can still help to carry the investment portfolio through this period of risk, as we see in the Global Financial Crisis (below) and for the Covid-19 downturn.

Performance of a Dividend Portfolio during the Global Financial Crisis

While dividend investing is not supposed to work as a hedge against Sequence of Returns Risk in theory, it does seem to work in practice, and under simulations, even after adjusting for the lower price gains of dividend stocks. Why? Part of this may be the same reason why there should be no difference between dividends in price gains in theory. The dividends are paid out from Net Asset Value (NAV), and the price of the stock falls when the dividend is paid. But in a downturn, the stock price can fall below the level of NAV, say, 0.8 of NAV. Then, as the dividend gets paid, the share price falls, but by only 80% of the dividend paid. This means that dividend investing can result both in income, and lesser loss in portfolio value during a downturn!

3. Spending in Retirement

But wait! There is more! More benefits for retirees who are in the decumulation phase and practising dividend investing, that is. Recent research by Blanchett and Finke (2021) show that the propensity to spend from dividends tends to be higher than spending from price gains. That is to say, retirees tend to spend more of their dividend income than from selling stocks they own for cash. Why does this matter? Well, the research result is the opposite of what Shefrin and Statman (1984) posited, that dividend investors use dividends as a form of self control, to avoid spending too much from their assets. Instead, what we see is that retirees may tend to spend too little, especially in the face of stock market volatility, and hence leave too much of their asset behind for their heirs, while living too frugally for their wealth.

This is actually logical. When we have cash on hand from dividends, the spending decision is easier than if we had to sell assets. In a market downturn, when faced with Sequence of Returns Risk, that decision to sell and spend is even harder. After all, many withdrawal rate decision rules require retirees to cut down on non-essential spending to hedge Sequence of Returns Risk. However, historically, maintaining spending at the safe withdrawal rate has almost always proven to be the better choice. But this is psychologically hard to do. Hence the benefits of using dividend investing to make this choice easier. Underspending in retirement is almost as bad as overspending, especially if there is really no need to spend less!

4. Popularity of dividend investing in Singapore as a once-in-a-lifetime occurrence

Perhaps one reason as to why dividend investing is so popular here in Singapore, and less so elsewhere in the world, is that by a historical quirk, a dividend portfolio consisting largely of blue-chip Real Estate Investment Trusts (REITs) has been wildly successful over the past two decades since their introduction to this part of the world. This might have been due to a number of factors:

- The novelty of the REIT securities. Initial pricing of REIT yield’s at a level (above government bonds) much higher than comparable stocks or even REITs elsewhere in the region

- The scarcity of blue-chip REITs with strong sponsors, plus a worldwide fall in interest rates. Both of these lead to eager investors, both retail and institutional (like insurers), pushing the prices up

- The ability of the sponsors to continually inject new assets into the REIT portfolios and to sell off older ones before lease decay set in, resulting in continued gains in asset value over time

However, there are signs that these factors may not persist in the future. Especially when interest rates look poised to rise again. Hence, dividend investing may not prove as effective in the future in Singapore, as it has been in the past!

Conclusions

So, when does dividend investing work? And when doesn’t it work?

From a theoretical perspective, and for practical tax reasons, dividend investing should not work as well as other forms of investing for accumulating wealth. From an empirical perspective, it hasn’t really worked as well too. But there are specific instances when it should, and can work well. Such as in hedging Sequence of Returns Risk. Or ensuring that we spend enough during retirement. However, this use of dividend investing only arises during a very specific period of one’s investing career. So, this is good news for dividend investors if you are Boomer, but not so good for everyone else!

Alternatively, dividend investing can work, if we are careful about not spending away the dividends. And instead reinvest them elsewhere. Unfortunately, this is not the main reason why investors flock to dividend investing in the first place!

Dividend investors need to be careful not to squander away the dividends earned in order to accumulate wealth at a similar rate to other ways of investing!

References

Blanchett and Finke (2021) Guaranteed Income: A License to Spend

Samuel Hartzmark and David Solomon (2018) The Dividend Disconnect. (Also see here. And here)

8 thoughts on “Dividend Investing: When does it work, and when doesn’t it work?”