Did the 2023 Property Market Cooling Measures Work?

More than a year ago, the property market in Singapore was set abuzz when the latest round of property market cooling measures were introduced, amidst the unrelenting rise in property prices. Property market cooling measures have been introduced in the Singapore market since as far back as 1996 (see this Business Times article for a full summary). However, the preferred measures of Additional Buyer’s Stamp Duty (ABSD), Loan-to-Value (LTV) and Total Debt Servicing Ratio (TDSR) restrictions date back only to 2011. Back then too, we suggested that these property market cooling measures based on the higher ABSD of up to 60% for foreigners will not work in our blogpost Do Property Market Cooling Measures Work? Why ABSD does not work. So, did the 2023 property market cooling measures work? Were we right, or did we get the nature of the property market all wrong?

Why did we think that the 2023 property market cooling measures wouldn’t work? For a start, the history of property market cooling measures in Singapore prior to 2023, as shown in this chart below (from SRX) gives a perspective of how little these measures have affected the unstoppable rise of property prices over the past 15 years. This is obviously a very large chart, and it is far better to view it at the source.

Timeline of Property Market Cooling Measures and Non-Landed Property Resale Price Index and Sales Volume

But the 2023 property market cooling measures were supposed to be different, right? After all, these were the most aggressive hikes in Buyer’s Stamp Duty seen for years. So, how did it go?

Do Property Market Cooling Measures work at all?

Why ABSD Property Market Cooling Measures Don’t Work in practice?

Let’s take a quick recap of the reasons why ABSD property market cooling measures do not work in practice. This is what we cover previously in Do Property Market Cooling Measures Work? Why ABSD does not work.

In a normal market, the price and quantity transacted is determined by the demand and supply curves.

Demand and Supply in a Property Market

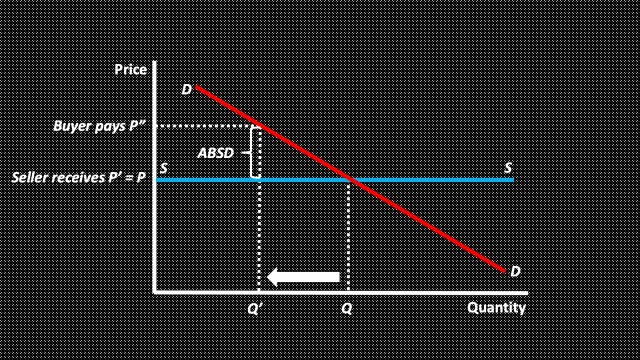

If there is a tax like ABSD, the demand and supply curves do not change. Instead, a wedge is driven between what the buyer pays and what the seller receives. Regardless of the name of the tax, whether a seller’s tax or a buyer’s tax, the effect is the same. Depending on the slope of the demand and supply curves, buyers and sellers both share the tax burden. The buyers will pay more than what they had originally been willing to pay, and the sellers get less than what they had been willing to receive. The government also gains in this case from the amount of tax revenue raised. But overall, there will be fewer transactions compared to before the tax.

Using ABSD to Cool the Property Market

But these taxes, SSD or ABSD, have done nothing to reduce prices in the private property resale market historically in Singapore. In fact, the only impact has been to reduce the number of transactions. This means that the property market in Singapore does not conform to the canonical demand-supply case shown above. Rather, it appears that the supply curve is flat. Only in such a case will we have prices remaining unchanged while transaction volumes fall upon the imposition of the tax.

Why ABSD May Not Work to Cool the Market

So, from what can observe, using ABSD as a property market cooling measure does not achieve the desired effect of cooling the market. What it does achieve is to increase the tax revenue collected by the government.

After a Year of Higher ABSD, Interest Rates, and Money Laundering

Now that it’s been a year since the lat round of property market cooling measures, have they been effective? Or, like the model above, the only effect is to lower property transaction volumes? Let’s take a look at the data, courtesy of SRX.

First up, the index of private non-landed prices in from May 2022- Apr 2023 (the year prior to the latest property market cooling measures) and then from May 2023-Apr 2024 (the year after the measures).

SRX Non-Landed Property Price Index Apr 2022- Apr 2023 and Apr 2023-Apr 2024

Source: SRX

Hence, a year and 4 months after the previous round of cooling measures (16 Dec 2021), private property prices continued to rise by some 8.72%, while after the latest round of measures (27 Apr 2023), private non-landed property prices still continued to rise by some 5.05%! It is almost like the increase in ABSD has no impact! While the rise in the property price index recently is less than the gain the year before the latest round of property market cooling measures, remember that 2023 was also a period of peak interest rates and also more scrutiny of money laundering, especially in the property market in Singapore. Hence, we would expect the market forces to be pushing property prices downwards, and yet they continued rising!

So, the private property market in Singapore seems to be impervious to any manner of cooling measures, just like our little demand-and-supply model indicates. What about the volume of transactions? Do transactions also fall as our model predicts?

Private Non-Landed Property Transactions Apr 2022- Apr 2023 and Apr 2023-Apr 2024

Source: SRX

In contrast to the data on property prices, the data on transactions volume is curious indeed! Following the Dec 2021 cooling measures, the transaction volumes declined significantly over the following year and beyond, just like our model of the flat supply curve of property predicts. However, following the Apr 2023 cooling measures, we see that transaction volumes have remained steady subsequently, which is at odds with our model! What’s happening here? Is there something we are missing?

What’s the Demand And Supply of Private Non-Landed Property Like?

The rather anomalous behaviour of private property transaction volumes in the past year does tell us something has changed in the property market in Singapore recently. If we go back to our demand and supply models once again, we find that the only possibility for prices to continue rising and transaction volumes to remain steady after the imposition of ABSD is if the supply curve is flat, and the demand curve is vertical:

A Possible Model of Demand and Supply in the Private Property Market in Singapore

As before, the flat supply curve ensures that the price level of property does not fall even with the imposition of a tax like ABSD. Additionally, as the demand curve for property becomes more and more vertical, the transaction volumes will be less and less affected by the imposition of the ABSD as well. In the extreme case where the demand curve is perfectly vertical, all that the ABSD will do is to increase tax revenues, while not changing anything in the market. In short, a perfect tax!

But what might happen to change the demand curve for private property from a downward sloping one, to one which is vertical? One possibility is that as property in Singapore, especially at the higher end, become safe haven assets, or even trophy assets, demand for them become inelastic. This is much like the case for prime properties in New York or London, which is recession-proof!

Alternatively, as supply fails to keep up with the demand for property to live in, especially given high levels of home ownership, there may be an element of “fear of missing out” driving the “buy at any cost” behaviour in property purchases.

Whatever the reasons, it is safe to say that the market for private property in Singapore has become even more interesting, both for buyers and seller! And neither demand management, nor supply policies can do anything to affect the trajectory of property prices! Short of a deep recession, or even depression.

Some other good reads on property

- What Really Drives HDB Resale Flat Prices in Singapore?

- What’s the Value of my Leasehold Condominium (1)? Revisiting Mr Bala’s Table

- What’s the Value of my Leasehold Condominium (2)? Is freehold better or leasehold?

- What’s the Value of my Leasehold HDB (3)? Dealing with HDB Lease Decay

- The DBS Home Equity Income Loan: Good or Bad?

- Should I Pay Off My Mortgage Before Retiring Early?

- Do Property Market Cooling Measures Work? Why ABSD does not work

- What Property Cooling Measures May Work in Singapore?