What Property Cooling Measures May Work in Singapore?

Singapore has had a long love-hate relationship with property cooling measures. These have been introduced since 1996 (see this Business Times article for a full summary), starting with Seller’s Stamp Duty (SSD), to Additional Buyer’s Stamp Duty (ABSD), to Loan-To-Value (LTV) restrictions, and Total Debt Servicing Ratio (TDSR) measures. Love-hate, because people looking to buy a property welcome these measures to make property more affordable, and people who own property bemoan these measures for stopping them growing richer faster.

Reducing Property Price Inflation Using Property Market Cooling Measures

But the fact of the matter is that all these property cooling measures introduced have not been very successful. In fact, looking at the chart below from SRX, we can see that apart from the period between 2014 and 2017, none of the property cooling measures have resulted in a decline in private resale property prices. At best, price growth has only slowed.

A History of Property Market Cooling Measures in Singapore

In our previous post Do Property Market Cooling Measures Work? Why ABSD does not work, we looked at ABSD in particular. This has been the favoured cooling measure in recent years, rolled 5 times already, and why it does not work in Singapore. Even the latest round of ABSD, which raise the stamp duty for foreigners to a staggering 60%, has not made any dent in the property prices.

Given this sorry state of affairs in policy making, we can wonder, what property cooling measures work in Singapore? To do so, we can look at three different types of cooling measures:

- Taxes, like SSD and ABSD

- Demand-side measures

- Supply-side measures

Using Taxes as a Cooling Measure

In a normal market, the price and quantity transacted is determined by the demand and supply curves, as shown below:

Demand and Supply in a Property Market

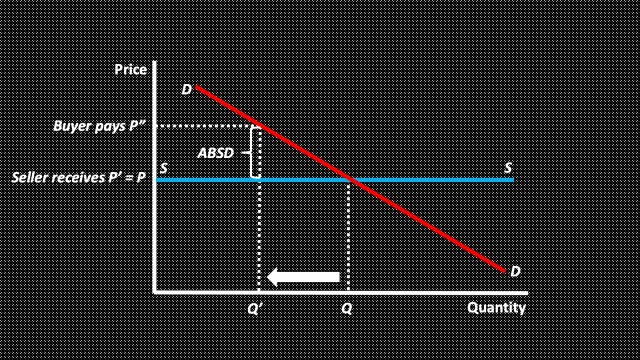

If there is a tax, the demand and supply curves do not change. Instead, a wedge is driven between what the buyer pays and what the seller receives, as shown below. Regardless of the name of the tax, whether a seller’s tax or a buyer’s tax, the effect is the same. And more interestingly, it does not matter if the tax is levied on the seller or the buyer. Depending on the slope of the demand and supply curves, buyers and sellers share the tax burden. The buyers will pay more than what they had originally been willing to pay, and the sellers get less than what they had been willing to receive. The government also gains in this case from the amount of tax revenue raised. But overall, there will be fewer transactions compared to before the tax.

Using a Tax to Cool the Property Market

But these taxes, SSD or ABSD, have actually done nothing to reduce prices in the private property resale market. In fact, the only impact has been to reduce the number of transactions. This means that the property market in Singapore does not conform to the canonical demand-supply case shown above. Rather, it appears that the supply curve is flat, as shown below. Only in such a case will we have prices remaining unchanged while transaction volumes fall upon the imposition of the tax.

Why a Tax May Not Work to Cool the Market

So, from what can observe, using taxes as a property cooling measure does not achieve the desired effect of cooling the market. What it does achieve is to increase the tax revenue collected by the government.

Cooling Measures which Affect the Demand for Property

So what else can we do to cool the property market? Another type of cooling measure relies on reducing the demand for property. This has the effect of shifting the demand curve downwards. In other words, buyers will offer a lower price for every property. This is shown below:

Reducing Demand to Cool the Property Market

What sort of cooling measure can achieve this effect? For a start, any measure which reduces the purchasing power of the buyers will do so. A recession, like the ones in 1998 (Asian Financial Crisis), 2003 (SARS), and 2008 (Global Financial Crisis) can do this too.

Policy-wise, these measures usually take the form of loan restrictions, since most property purchases are financed using loans. For example, the reduction of the Loan-to-Value from 90% to 80% means that effective debt-financed purchasing power of a buyer will have been reduced by 50%. A buyer with cash-in-hand of $100,000 has an effective purchasing power of $1,000,000 when the LTV is 90%, but only $500,000 when the LTV is 80%. A restriction on the Total Debt Servicing Ratio, by tying the loan repayments to the income of the buyer, also has the same effect on property demand.

Given how drastically how even small changes in the LTV or TDSR can affect demand, it is a surprise that such measures have not been more effective. Looking back, LTV measures were imposed in 2010, 2011, 2013 and 2018, but only after 2013 and 2018 did private resale property prices pause in their relentless rise. TDSR measures were imposed in 2013, and thereafter, the prices did take a dip, for the first and only time in the long history of property cooling measures.

Part of the reason for the ineffectiveness of the LTV measures introduced (reducing LTV from 90% to 80%, and then to 75% for first properties) has been that the lending banks have usually been more cautious than what the cooling measures require. Bank have often made loans with 80% LTV even when the policy allowed for 90% LTVs, and also made loans with 75% LTV when policy allowed for 80% LTVs. On the other hand, the TDSR cooling measure introduced in 2013 was generally seen as being more stringent than what lending banks had been doing up until then, hence the greater effectiveness of the measure.

Another reason for the lack of effectiveness of the demand-side property cooling measures can be seen below. If the supply curve for property is flat, demand-side cooling measures have no impact except for reducing the volume of transactions. Perhaps the supply curve does slop upwards when prices are lower (representing seam sellers willing to accept lower prices), but it appears that only a very severe demand shock (for example due to a recession) can reach this levels.

Reducing Property Demand When the Supply Curve is Flat

Net, demand-side measures like LTV and TDSR restrictions can work, but may have to be so severe now that it would hurt the property market badly!

Cooling Measures which Affect the Supply of Property

The final class of property cooling measures are those which increase the supply of properties in the market. An increase in supply can lead to a shift in the supply curve downwards, as the threat of oversupply forces sellers to accept lower prices. This in turn will lead to lower prices, and great transaction volume, as shown below:

Increasing the Supply of Property

However, such supply-side cooling measures have never been implemented explicitly, at least not for the private property market. In fact, what has been more common is a pullback in the Government Land Sales program whenever property prices look like they are weakening. Which is exactly the opposite of a supply-side cooling measure! In the HDB market at least, the sharp increase in the construction of new HDB flats between 1996 to 1999, and again in 2012 to 2015 did lead to a fall of the prices in the resale HDB market (as discussed in our previous post What Really Drives HDB Resale Flat Prices in Singapore?).

Thus, supply-side cooling measures look like exactly the sort of policy and cooling measure we need to cool the relentless rise in property prices. Lower prices and higher transaction volume, leading to greater liquidity – what is there not to like? But will this work in the market with a flat supply curve?

If the increase in supply were large enough, then the supply curve will fall, leading to the best outcome in terms of what a cooling measure sets out to achieve. We show this below:

Increasing the Supply of Property When the Supply Curve is Flat

However, there is also the possibility that the supply-side measures will fall short, leaving the flat supply curve unchanged. After all, we are already seeing a steady flow of 20,000-25,000 new HDB flats built every year, and another 10,000 to 15,000 private condominiums as well. And this yearly increase in property supply has hardly any impact in terms of slowing or stopping the rise in property prices! This will be the situation below:

What if the Increase in Property Supply is Too Small?

Hence, while supply-side cooling measures have the best possible outcomes, given the limits to construction capacity and land availability, there are several hurdles to overcome first to make them work.

Conclusions: Only supply-side property cooling measures have any chance of working

Singapore is characterised by an obsession by its inhabitants over property, a lover-hate relationship with property market cooling measures, and relentlessly rising property prices. While the history of property cooling measures introduced has almost exclusively focused on taxes and demand-side measures, neither of these have worked well. And in fact, they may never work well given the unique characteristics of the property market here.

That just leaves us with supply-side cooling measures, which have a chance of working when sufficient new housing is available. In short, build more houses! That is a conclusion that every country and market which has high and rising property prices has found out.

Some other good reads on property

- What Really Drives HDB Resale Flat Prices in Singapore?

- What’s the Value of my Leasehold Condominium (1)? Revisiting Mr Bala’s Table

- What’s the Value of my Leasehold Condominium (2)? Is freehold better or leasehold?

- What’s the Value of my Leasehold HDB (3)? Dealing with HDB Lease Decay

- The DBS Home Equity Income Loan: Good or Bad?

- Should I Pay Off My Mortgage Before Retiring Early?

- Do Property Market Cooling Measures Work? Why ABSD does not work

- Did the 2023 Property Market Cooling Measures Work?

what if it has been working. but to cool the market, just not enough to make it drop? the housing price increase is a situation we see in pretty much every country, a large part due to post 2008 and post covid liquidity conditions. if our prices has increased less than others, would you consider that to be working?

Yes, you are right. In theory, holding property prices constant to allow wage growth to catch up would be the best outcome to cool the market without precipitating a major property market crash. This would allow the price to income multiple to drop to more affordable levels over time. Apart from the period 2014-2017, it is not clear whether this has been achieved.

Was the ppty cooling measure just about bring the prices down or just to slow down? We will never know. If there were no measures, How would that looking 10 years in the making? We will never know as well.

I am sure that the policymakers have their own goals and objectives for all these series of measures, which may not be public knowledge. All we can do is to observe the outcomes and try to understand the nature of the market better.