How to Spend Your Retirement Savings (2): Combining CPF Life with Investments

Previously, we looked at how people spend in retirement, and found that despite most of the retirement products and plans giving either a flat level of spending, or an inflation adjusted level of spending, no one actually spends in retirement in such way! While it is entirely possible to generate different sustainable profiles from an investment portfolio, a better idea is combining CPF Life with investments. In fact, what we find is that you will always be better off when you combine a CPF Life Escalating Plan with spending from an investment portfolio, and can not only decide on the spending profile you’d prefer in retirement, but also how much you aim to have as an emergency fund or as a legacy.

After a lifetime slogging and socking away money into investments, retirement beckons! Will retirement be a long period of idle bliss, where you fulfill your “bucket list”, like sipping martinis while enjoying the sunset on a beach, or will it be a nerve racking period where you are constantly worrying about whether the financial markets are holding up, and whether you can sustain the lifestyle you want for 20 to 30 years?

Retirement … sipping martinis on a deserted beach

We started addressing this question in our previous post How to Spend your Retirement Savings (1): How much can I spend from my investments? where we look at the the different spending profiles in retirement which are sustainable using a Yield Shield portfolio to protect against Sequence of Returns Risk early in retirement. Here, we take our analysis a step further by looking at how combining CPF Life with investments helps us to obtain even better spending profile outcomes in retirement.

How retirement spending works together with CPF Life

Now, almost every Singaporean who is currently planning for retirement will retire with a CPF Retirement Account which is put into a CPF Life annuity. Previously, we examined the various CPF Life Plans (here, here and here) to figure out which is the best option among the Standard, Basic and Escalating Plans to take up. But as many others have done so, these are done on a standalone basis, i.e. the retiree has no other sources of income in retirement apart from CPF Life. Clearly, for anyone planning for retirement, this is unlikely to be the case. What is more likely is that you will retire with some other investments in stocks and bonds, and perhaps a residual balance in your CPF Special or Ordinary Accounts as well.

CPF Life really only offers two types of plans – a flat payout, and an increasing payout (which starts at a lower level), both for the rest of your life, as we show below:

Two types of CPF Life payout profiles – flat or rising

At first glance, this is no big deal, as we can easily reproduce this sort of payout profile using an investment portfolio, and which can last for at least 30 years without running out of money (with 95% likelihood). But what is interesting about the CPF Life Plans is that the Escalating Plan, where the payouts start lower but increase at a rate of 2% a year, crosses over, or “breaks even” with the Standard and Basic Plans before the 10th year (age 75). When we look at recreating such payout profiles with an investment portfolio, we typically find that the crossover or break-even point between a inflation adjusted and a flat profile occurs much later, around the 22nd year.

Sustainable retirement spending profiles from an investment portfolio

What this means is that CPF Life has a comparative advantage in generating an inflation adjusted, or rising payout profile, compared to the DIY approach of using an investment portfolio. This is due to the annuity structure of CPF Life, where the returns towards the end of the annuity are very large due to the returns from longevity, making it easy to ensure that rising payouts can be guaranteed. In contrast, the DIY approach struggles to generate rising payouts over time, because there is a need to grow the assets over the long term even while they are being drawn down to make payments in the near term.

This also means that the best way to use CPF Life is to opt for the Escalating Plan, when we combine the retirement payouts from CPF Life with our own investment portfolio. We take a look at how this will turn out next.

Combining CPF Life with an Investment Portfolio

Previously, we looked at 5 different retirement spending profiles, which we also show are sustainable using a 100% Yield Shield portfolio with a starting value of $1 million. Let’s recreate the same profiles, but using a $1 million portfolio from age 65 which is allocated as follows:

- $400,000 in the CPF Retirement Account which is the maximum with a Enhanced Retirement Sum of $271,000 at age 55

- $480,000 in the Yield Shield portfolio, with an average dividend yield of 4.55%

- $120,000 in the CPF Special Account, which pays an interest rate of 4%

Let’s look at a flat payout profile and an inflation adjusted payout profile first, and compare them to the previous results we get when using a 100% Yield Shield portfolio:

Comparing payout profiles between a 100% Yield Shield portfolio and a CPF Life/Yield Shield combination

When we pair a CPF Life Standard Plan with a flat spending profile (dotted blue line), we get an uplift of 10%, in terms of the payout amount. But what is staggering is that when we pair the CPF Life Escalating Plan with an inflation adjusted spending profile (dotted orange line), we get a much bigger uplift of 26% in terms of the payout amount! This goes to show that the CPF Life Escalating Plan is comparatively much more effective at generating rising payouts over time. Let’s look at a coupe of other spending profiles where we use the comparative advantage of the CPF Life Escalating Plan once again:

Comparing payout profiles between a 100% Yield Shield portfolio and a CPF Life/Yield Shield combination

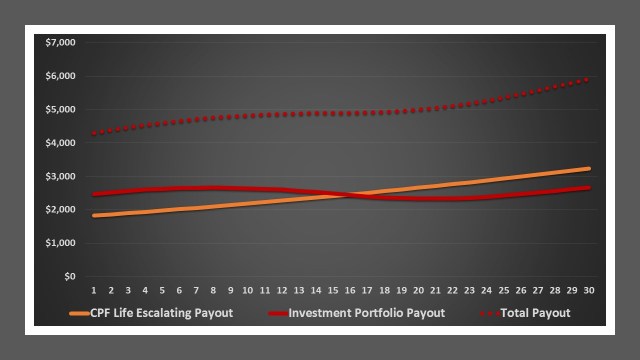

When we pair a CPF Life Escalating Plan with the Actual Adjusted spending profile (dotted red line) we wrote about previously, we get a 22% uplift in the initial payout amount. Similarly, when we pair a CPF Life Escalating Plan with the Healthcare Adjusted spending profile (green dotted line), we get a 23% uplift. Looking more closely at the Actual Adjusted spending profile, we see in the chart below that this spending uplift essentially comes from pairing the rising payout profile of the CPF Life Escalating Plan, with the flattish payout profile from the investment portfolio So, we are using the two financial resources for retirement to their best comparative advantage.

Combining the payouts from the CPF Escalating Plan and the Investment Portfolio

But is there really a free lunch when using the CPF Life Escalating Plan? How is it possible that we can get a 20%+ higher payout from the same financial resources of $1 million? Actually, there isn’t a completely free lunch here, as the $400,000 in the CPF Retirement Account put into CPF Life will not have any residual value when the CPF member passes on, whereas the investment portfolio still has residual value which can be left to his/her heirs. Let’s look at how large the difference is.

Median portfolio value at the end of 30 years

| CPF Life + Investments | Investments only | Difference | |

|---|---|---|---|

| Flat | $477,000 | $597,000 | -20% |

| Inflation Adjusted | $575,000 | $831,000 | -31% |

| Actual Adjusted | $435,000 | $695,000 | -28% |

| Healthcare Inflation | $521,000 | $783,000 | -34% |

When we use CPF Life in combination with an investment portfolio, we will invariably end up with less money in the investment portfolio when we pass on. While this amount can be anywhere between 20% to 34% less on average, remember that we start retirement with an investment portfolio which is 40% smaller than under the pure “Investments Only” case. So using a combination of CPF Life and investments is still more efficient in terms of preserving assets.

Looking at it from another perspective, we give up between 20% to 34% of the investment value in 30 years time, for a 22% to 26% increase in spending power today. This seems like a more than fair exchange! We can also opt to spend a little less from investments now, to increase the future residual value. For example, under the “Healthcare Inflation” spending profile, we can essentially get the same value of the investments in the portfolio at the end of 30 years if we opt to payouts which are 9% higher (rather than 23% higher). Yet another option is to move the portion in CPF Special Account into equities to get a higher future value. Hence, we will always be better off pairing our investment portfolio with a CPF Life annuity.

Can we do the same if we have other spending objectives in retirement?

One drawback of CPF Life is that the payouts only start from age 65 at the earliest. What if we have alternative spending objectives for retirement, or are overtaken by events such as ill health, retrenchment etc., all of which may result in retirement plans being brought forward? In these cases, the first few years of retirement may need to be funded entirely by investments alone, leaving less for the future. Let’s look at a few case studies of combining CPF Life with investments.

Suppose we have 4 retirees, and their stories are as follows:

Albert: Plans to retire later at age 67

Albert is offered re-employment at the age of 62 and continues working until he is 67. Hence he only starts his CPF Life payouts at that age, and also starts drawing from his other investments of $600,000. The 2 year delay in starting his CPF Life payouts means he will get a higher payout. At the same time, he only wishes for his payouts to go up by 1.5% a year, as he feels his consumption would slow down over time. How might his sustainable retirement payouts from CPF Life and his investment portfolio look like?

As Albert starts retirement later, and doesn’t need a payout which goes up at the same rate as inflation, he can afford to start his retirement payouts at a higher level of $4,200 a month. He will also be able to accumulate a median expected sum of $558,000 at the end of 28 years of retirement, which is pretty amazing, given that he starts off with just $600,000 in his investment portfolio!

Beatrice: Plans to live out her retirement dreams first

What about someone who has a plan for what to do in retirement? Beatrice wishes to start retirement at age 65 with a high, but level, payout for the first 5 years as she ticks off all the countries which she wishes to visit. After that, she will settle for a payout that is 20% lower from age 70 to 80 as she sees herself staying at home to look after her grandkids. But she fears that her medical costs will go up sharply in her old age, so wants her payouts to resume rising at a higher rate of 2.5% a year (in line with medical cost inflation) from age 80 onwards. What is a sustainable retirement payout level for her, given her starting resources of $400,000 in CPF Life and $600,000 in investments?

In Beatrice’s case, she can afford to start off her retirement with a high payout of $5,133 per month for the first 5 years. Much of this will actually come from drawing down on her investments, as the CPF Life Escalating payouts for women starts lower than for men, due to their longer lifespans. However, the CPF Life payouts will eventually comprise the majority of her payout, and she will end up with a median value of $440,000 in investments at the end of 30 years.

Charlie: Forced to retire earlier than planed

What about someone who retires earlier than planned? Charlie is a little less fortunate, not being able to take up re-employment at the age of 62 because of poor health. This means that he starts retirement three years earlier than planned, and before his CPF Life payouts start. It also means that he starts off retirement by drawing down on his investments initially. And to make it worse, because he retires 3 years earlier than planned, he only has $510,000 in investments due to missing out 3 extra years of compounding returns and savings from his salary. Fortunately, he doesn’t want a fancy retirement, content with a payout from age 62 which rises at the inflation rate of 2% a year. How can he make this work?

Retiring earlier than planned can mess things up a bit for retirement. In Charlie’s case, he needs to finance the first 3 years of retirement from a smaller pool of savings and investments. This means that he can only start off at $3,000 per month, less than the $3,554 he could have if he retired at age 65. However, things start looking up 3 years later when his CPF Life payouts start, and he can look forward to a median expected value of $425,000 left in his investment portfolio 30 years later (remember he started off with only $510,000).

Tricia: Early retirement!

What Charlie’s example shows is that early retirement needs to be carefully planned for, even if it is not currently on the cards now. Who knows what the future may bring? Take Tricia, who dreams of retiring at age 60, even though this means that she may only have $$480,000 in savings and investments to cover the first 5 years of retirement before her CPF Life kicks in at age 65. In planning to make her money last, she decides that she can make do with a flat level of payouts for the first 15 years of retirement (to age 75) before having these payouts rise by 1% a year thereafter.

Much like Charlie’s case, Tricia can only afford to start her retirement with a monthly payout of $3,000. Even after her CPF Life kicks in, she will not be able to draw more than $4,000 a month even towards the end of 30 years, due to her starting savings and investments being lower. Also, as a woman with a longer lifespan, her CPF Life also pays her less. And she ends up on the edge as well, because her initial $480,000 of savings and investments can dwindle down to $144,000 after 35 years in the median case. So even while this retirement spending profile is sustainable, it does present some risks, especially if healthcare costs rise very, very sharply, since there is little left in the investment portfolio which can act as an emergency fund.

Some concluding thoughts

Most people who subscribe to the FIRE movement think in terms of how much they can spend, or withdraw, from their investment portfolio when they retire. Others, who plan to retire at age 65, look to CPF Life alone for their retirement spending needs, and conclude that the Basic or Standard Plans, which give a flat level of retirement payouts, is the best option for them.

In reality, both these camps may be mistaken! For the people in the FIRE movement, they should not neglect the fact that an annuity like CPF Life is a powerful hedge against longevity, and needs to be actively considered and incorporated in their plan for spending from their investments. For other people who plan to retire on CPF Life, they should also realise that combining a CPF Life Escalating Plan with their other investments will give them a standard of living far higher than one or the other by itself.

So, our takeaways are:

- Combining an annuity like CPF Life with spending from investments is the best way to achieve a higher level of retirement income, and leave behind something for your heirs, or to have as an emergency fund

- When combining CPF Life with investents, contrary to most analyses of CPF Life, the best CPF Life Plan option is the Escalating Plan, because it is much more effective in generating a rising stream of income.

- Early retirement, whether planned or unplanned, before CPF Life kicks in at age 65, can be pretty costly. This is something which we will investigate in a future post.

Do keep reading this blog for our future post where we shall also look at putting all these findings together to work out how much it costs to retire early in Singapore. Also, what happens after you are retired and start to wonder if you still have enough to carry on, especially after going through a market downturn? We address this question here.

6 thoughts on “How to Spend Your Retirement Savings (2): Combining CPF Life with Investments”